But rising darkish pool liquidity may invite the capital wanted to calm the waters of an trade plagued with worry and uncertainty. In reality, in 2014, off exchange buying and selling accounted for nearly 40% of all trades in U.S. shares. By having the key split into shares, we construct a distributed trust mannequin where no single party can view excellent orders (which would violate merchants’ privacy).

Nodes run multiparty computations and compete with one another to match essentially the most orders and are rewarded with a portion of the general fee for every match. Order fragments which are matched are recorded within the system and a notification is sent to different nodes relating to the match. More technically, it makes use of multiparty computation protocol (MPC) engines. It will take the large cryptocurrency orders and break them down into a bunch of smaller orders. There have additionally been different choices from the large cryptocurrency trade, Bitfinex.

Instinctively, you may anticipate a speedy worth decline should the order be executed, leaving you on the wrong facet of the market. Even if the market possesses sufficient volume to soak up such a big transaction, day traders and short-term traders sometimes react impulsively. This collective behaviour may swiftly result in a mass sell-off, escalating into a panic-driven market frenzy.

Their origins in conventional markets return a number of a long time, enabled by SEC regulation, which allowed buyers to trade securities off-exchange. Major investors and organizations utilize dark swimming pools to speculate large sums of cash in financial products anonymously and discreetly. A block commerce is the purchase crypto dark pool of a appreciable quantity of an asset at a predetermined price. These exchanges function exterior the standard exchanges like NYSE and NASDAQ. While darkish swimming pools have been seen as a great way to supply liquidity, they have additionally been blamed for the position they’ve played in some market flash crashes.

When an equity transaction is placed by way of a centralized exchange, large orders could lack liquidity. Continuous double auctions are prevalent within traditional finance, permitting buyers and sellers to submit orders every time they want. Matching happens on a steady basis, that means as soon as an order comes in the operators seek for a counterparty/match. There are a few venues within conventional finance in which auctions are accomplished “periodically,” meaning patrons and sellers can submit orders during a specified time period and crossings are performed at a set time.

Differences Between Crypto Darkish Pools And Standard Dark Swimming Pools

The darkish pool’s opaqueness can also give rise to conflicts of interest if a broker-dealer’s proprietary traders trade in opposition to pool purchasers or if the broker-dealer sells particular access to the darkish pool to HFT firms. The promise of decentralized darkish pools is the right state of affairs for institutions to onboard into DeFi en masse. Republic Protocol (REN) was a decentralized darkish pool that used atomic swaps to supply customers with cross-chain crypto trading. It allowed the trade of Ethereum, Bitcoin, and other ERC-20-based tokens. The protocol’s native token, REN, was used to reward nodes that carried out the order-matching process contained in the protocol.

They implement measures to deter fraudulent activities and protect buyers. All in all, remember that while the privacy and anonymity aspects of dark pool trading could additionally be appealing, the potential risks of engaging in it shouldn’t be overlooked. Dark pool trading has attracted regulatory scrutiny because of its potential dangers. Regulators are concerned concerning the lack of transparency, which might hinder their capability to monitor and guarantee fair buying and selling practices. The veiled nature of dark pool trading opens the door to potential market manipulation.

Can You Commerce On Dark Pools?

Estimates show that it accounted for approximately 40% of all U.S. inventory trades in 2017 in contrast with roughly 16% in 2010. The CFA additionally estimates that dark swimming pools are liable for 15% of U.S. quantity as of 2014. Dark swimming pools are typically cast in an unfavorable mild but they serve a purpose by permitting massive trades to proceed with out affecting the wider market.

For example, if a well-regarded mutual fund owns 20% of Company RST’s inventory and sells it off in a darkish pool, the sale of the stake may fetch the fund a good price. Unwary traders who just purchased RST shares will have paid too much since https://www.xcritical.com/ the inventory could collapse as soon as the fund’s sale turns into public data. For securities, there are greatest execution requirements that require brokers to execute customers’ orders with essentially the most favorable terms potential.

Understanding Dark Swimming Pools: Crypto’s Hidden Buying And Selling Ecosystem

Apart from easing the liquidity, MPC and order fragmentation serves another actually essential perform. As the orders are split, it could be onerous to identify the initiating transaction. This means that the customer and vendor within the cryptocurrency transaction will deal immediately with the opposing party in a very anonymous yet trustworthy method. This may also make the transaction cheaper as there isn’t any centralized broker to facilitate the sourcing. If you had been to transact on a centralized trade, your competitors may simply see the trades you had been inserting. If they are in a position to see this, they may either try and block your acquisitions (on control grounds) or they may try and front run your positions.

It’s price noting, although, that DIX is a selected sort of DIP that displays how a basket of assets behaves within darkish pools. DIP, then again, can be utilized to measure completely different property across the board. Now that you’ve got got the basic information of what is darkish pool buying and selling system, you also needs to know that there are a quantity of types of swimming pools that exist. Each one has its own unique characteristics and operates underneath totally different possession constructions. Dark pool buying and selling techniques had been initially created to provide a discreet setting where institutional players might execute their trades with out inflicting significant market disruptions or revealing their methods to other traders. If price continues to fluctuate in one other way throughout markets, then arbitrageurs will take advantage and perpetuate the volatility.

In the crypto world, dark pool buying and selling features similarly to its traditional counterpart. It involves the non-public trading of digital assets, such as cryptocurrencies, away from public exchanges like Binance, Kraken, or KuCoin. Dark pool crypto trading provides a confidential setting for institutional buyers and high-net-worth individuals to execute large trades with out impacting the general market. By minimizing market impression, darkish swimming pools help to avoid value fluctuations that might occur if these massive trades have been performed brazenly on public exchanges.

What’s The Distinction Between A Crypto Trade And A Brokerage?

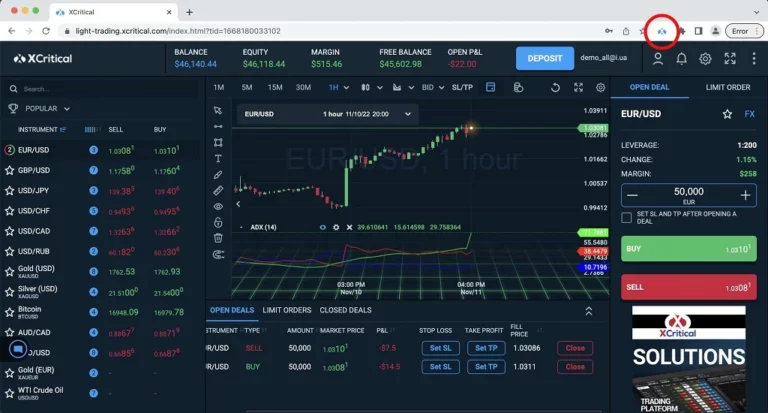

The govt added that Enclave Markets might look to supply a spot change sooner or later, as well as derivatives and swaps. Barclays and Credit Suisse paid roughly $150 million in fines in 2016 after being charged with dark pool violations. Another possibility might contain counting on some semi-trusted third get together to handle custody and settlement, in addition to shielding individuals’ exercise from the public (say by way of the use of wash accounts). However, as of writing, it appears that evidently the Kraken dark pool isn’t out there anymore. If you are using a particular program, you may even have entry to the moving averages of assorted tickers. This allows you to observe long-term developments in the market, providing priceless insights for more informed decision-making.

In 2016, Credit Suisse was fined greater than $84 million for utilizing its dark pool to commerce in opposition to its shoppers. Some have argued that dark swimming pools have a built-in battle of curiosity and ought to be extra intently regulated. On the open market, large block sales tend to lower the stock price, by growing the availability of the security obtainable to commerce. Dark pools allow giant institutional holders to buy or sell in giant volumes, with out broadcasting information that would affect the wider market. When retail traders purchase and promote shares and other securities, they usually go through a brokerage firm or their most popular online buying and selling platform.

Proponents of periodic auctions additionally argue that a discrete time mannequin allows participants to compete on worth (to the advantage of different system participants) somewhat than speed. 🌐 Dark swimming pools allow nameless transactions and divide massive inventory into smaller units, catering to various monetary capabilities. They operate through intermediaries who match patrons and sellers, maintaining confidentiality. These platforms are not open to the general public, however entry can be arranged by way of connections.

Electronic Market Maker Dark Swimming Pools

In this fashion, the trade shouldn’t get front-run, and maker orders can happen without slippage. Another possibility for an institution is to have interaction with digital property infrastructure corporations such as Fireblocks. They can provide the plumbing to entry totally different liquidity swimming pools, although the shortcoming with this strategy is that it’s not seamless. There might be a need for the market participant to have separate accounts with the various liquidity providers. Concordex is a cutting-edge Decentralised Exchange (DEX) that operates on the Concordium Blockchain.

Another vital advantage of darkish pool buying and selling is the potential for reduced transaction costs. In conventional exchanges, the bid-ask spread, which is the difference between the highest price a buyer is keen to pay and the bottom value a vendor is prepared to just accept, could be wide. The first dark pool was established by an institutional investor looking for a extra discreet buying and selling venue. Besides, initially, these different buying and selling methods operated independently from conventional exchanges. However, as their recognition grew, some exchanges determined to launch their very own darkish swimming pools to retain market share. A dark pool permits oversized market gamers to commerce large blocks of digital belongings with out the commerce being visible to the broader public.